-

CIMA

CIMA is the world's leading, and largest, professional body of management accountants

-

What is CIMA?

CIMA is the Chartered Institute of Management Accountants, it is the world’s largest professional body of chartered global management accountants, and offers the most relevant accounting qualification for a career in business and finance. Headquartered in United Kingdom, we have over 229,000 members and students in 176 countries.

-

-

Why Choose CIMA?

- It is versatile qualification that prepares you for a career in business and finance.

- Enables you to work in any sector anywhere in the world

- Provides you with global job opportunities

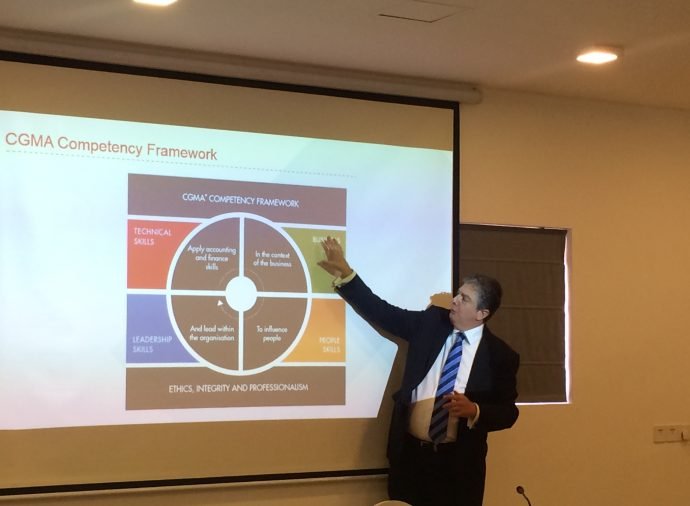

- Is progressive and helps you develop skills and competencies that are sought by employers

- Offers a flexible learning experience and exam scheduling to suit your lifestyle

- Provides you with the opportunity to top up your CIMA qualification with a university degree http://www.cimaglobal.com/Study-with-us/CIMA-and-a-degree/

- Grants you membership into the world’s largest body of management accountants

- Once a CGMA opens doors to other professional membership bodies, as you could also qualify for CPA Australia and CMA Canada Membership

- Trains you to maintain a high level of ethical and professional standards

- Is comparable to QCF (Qualifications and Credit Framework) Level 7 standard as per UK NARIC (National Recognition Information Centre)

-

It’s a great work bringing CIMA to Jaffna. Well done Guna & team. In the past this was not available for students in North & students from North were forced to travel to Colombo for their CIMA studies and only a few were able to do. I don’t a lot of the new generation new about this history but they should know about the history.

Computer facilities are good.

You have good staff

Good place to write CIMA Exams.

Great environment to do the exam make sure you give a call before the exam as a sign of confirmation.

-

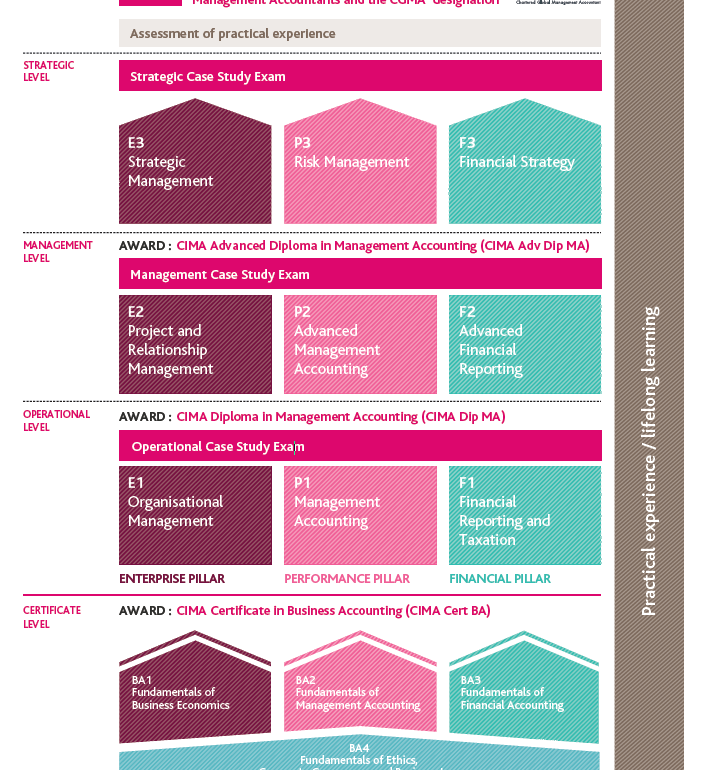

LEVEL OF CIMA

-

Certificate Level

BA1 Fundamentals of Business Economics

CIMA Certificate in Business Accounting (2017 syllabus)

Overview

This subject primarily covers the economic and operating context of business and how the factors of competition, the behaviour of financial markets and government economic policy can influence an organisation. It also deals with the information available to assist management in evaluating and forecasting the behaviour of consumers, markets and the economy in general.

The focus of this syllabus is on providing candidates with an understanding of the areas of economic activity relevant to an organisation’s decisions and, within this context, the numerical techniques to support such decisions.Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined.Weight

Syllabus topic

25%

A. Macroeconomic and Institutional Context of Business

30%

B. Microeconomic and Organisational Context of Business

20%

C. Informational Context of Business

25%

D. Financial Context of Business

Assessments

Format: computer based

Availability: on demand at any of the 5,500 Pearson VUE centres around the world

Length: 2 hours

Questions: BA1, BA2 and BA3 each contain 60 objective test questions, while BA4 contains 85 objective test questions.

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. In BA2 and BA3 short scenarios may be given to which one or more objective test questions relate.BA2 Fundamentals of Management Accounting

Overview

This subject deals with the fundamental knowledge and techniques that underpin management accounting. It identifies the position of the management accountant within organisations and the role of CIMA. The subject portrays the role of management accounting in the contexts of commercial and public sector bodies and its wider role in society.

The identification and classification of costs and their behaviour provides the basis for understanding and applying the tools and techniques needed to plan, control and make decisions. Budgetary control requires the setting of targets and standards which then allow the performance of organisations to be reported and analysed by the calculation of variances. Investment appraisal, break-even analysis and profit maximisation are used to inform both long and short term decision making.Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined.Weight

Syllabus topic

10%

A. The Context of Management Accounting

25%

B. Costing

30%

C. Planning and Control

35%

D. Decision Making

Assessments

Format: computer based

Availability: on demand at any of the 5,500 Pearson VUE centres around the world

Length: 2 hours

Questions: BA1, BA2 and BA3 each contain 60 objective test questions, while BA4 contains 85 objective test questions.

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. In BA2 and BA3 short scenarios may be given to which one or more objective test questions relate.BA3 Fundamentals of Financial Accounting

CIMA Certificate in Business Accounting (2017 syllabus)

Overview

The main objective of this subject is to obtain a practical understanding of financial accounting and the process behind the preparation of financial statements for single entities.

These statements are prepared within a conceptual and regulatory framework requiring an understanding of the role of legislation and of accounting standards. The need to understand and apply necessary controls for accounting systems, and the nature of errors is also covered. There is an introduction to measuring financial performance with the calculation of basic ratios.Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined.Weight Syllabus topic

10%

A. Accounting Principles, Concepts and Regulations

50%

B. Recording Accounting Transactions

30%

C. Preparation of Accounts for Single Entities

10%

D. Analysis of Financial Statements

Assessments

Format: computer based

Availability: on demand at any of the 5,500 Pearson VUE centres around the world

Length: 2 hours

Questions: BA1, BA2 and BA3 each contain 60 objective test questions, while BA4 contains 85 objective test questions.

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. In BA2 and BA3 short scenarios may be given to which one or more objective test questions relate.BA4 Fundamentals of Ethics, Corporate Governance and Business Law

CIMA Certificate in Business Accounting (2017 syllabus)

Overview

The learning outcomes in this subject reflect the professional standards to be demonstrated for the benefit of all stakeholders. With this in mind, the place of ethics and ethical conflict is an essential underpinning for commercial activity. Ethics is more than just knowing the rules around confidentiality, integrity and objectivity. It’s about identifying ethical dilemmas, understanding the implications and behaving appropriately. It includes the role of corporate governance, corporate social responsibility and audit; and their increasing impact in the management of organisations.

Wherever business is conducted the legal and administrative framework underpins commercial activity. With this in mind the areas of contract law, employment law, administration and management of companies is considered.Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined.Weight

Syllabus topic

30%

A. Business Ethics and Ethical Conflict

45%

B. Corporate Governance, Controls and Corporate Social Responsibility

15%

C. General Principles of the Legal System, Contract and Employment Law

10%

D. Company Administration

Assessments

Format: computer based

Availability: on demand at any of the 5,500 Pearson VUE centres around the world

Length: 2 hours

Questions: BA1, BA2 and BA3 each contain 60 objective test questions, while BA4 contains 85 objective test questions.

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. In BA2 and BA3 short scenarios may be given to which one or more objective test questions relate.Operational Level

By passing the level, you will gain the CIMA Diploma in Management Accounting

Operational level is the first level of the CIMA Professional Qualification and consists of three subject areas.

The technical content at the Operational level

The Operational level covers the implementation of strategy, as well as reporting on the implementation of strategy. Its focus is on the short-term.

E1 Organisational Management

Operational level

E1 focuses on the structuring of organisations. It covers the structure and principles underpinning the operational functions of the organisation, their efficient management and effective interaction in enabling the organisation to achieve its strategic objectives. It lays the foundation for gaining further insight into both the immediate operating environment and long-term strategic future of organisations, which are covered in E2 and E3.

Summary of syllabusEach subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.

Weight Syllabus topic 25% A. Introduction to organisations 15% B. Managing the finance function 15% C. Managing technology and information 15% D. Operations management 15% E. Marketing 15% F. Managing human resources Assessment

Format: computer based Objective Test

Availability: on demand at any of the 5000 Pearson VUE centres around the world

Length: 90 minutes

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. They test all component learning outcomes across the whole subject.

P1 Management Accounting

Operational level

P1 stresses the importance of costs and the drivers of costs in the production, analysis and use of information for decision making in organisations. The time focus of P1 is the short term. It covers budgeting as a means of short-term planning to execute the strategy of organisations. In addition it provides competencies on how to analyse information on costs, volumes and prices to take short-term decisions on products and services and to develop an understanding on the impact of risk to these decisions. P1 provides the foundation for cost management and the long-term decisions covered in P2.

Summary of syllabusEach subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.

Weight Syllabus topic 30% A. Cost accounting systems 25% B. Budgeting 30% C. Short-term decision making 15% D. Dealing with risk and uncertainty Assessment

Format: computer based Objective Test

Availability: on demand at any of the 5000 Pearson VUE centres around the world

Length: 90 minutes

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. They test all component learning outcomes across the whole subject.

F1 Financial Reporting and Taxation

Operational level

F1 covers the regulation and preparation of financial statements and how the information contained in them can be used. It provides the competencies required to produce financial statements for both individual entities and groups using appropriate international financial reporting standards. It also gives insight into how to effectively source and manage cash and working capital, which are essential for both the survival and success of organisations. The final part focuses on the basic principles and application of business taxation. The competencies gained from F1 form the basis for developing further insights into producing and analysing complex group accounts (covered in F2) and formulating and implementing financial strategy (covered in F3)

Summary of syllabusEach subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.

Weight Syllabus topic 10% A. Regulatory environment for financial reporting and corporate governance 45% B. Financial accounting and reporting 20% C. Management of working capital, cash and sources of short-term finance 25% D. Fundamentals of business taxation Assessment

Format: computer based Objective Test

Availability: on demand at any of the 5000 Pearson VUE centres around the world

Length: 90 minutes

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. They test all component learning outcomes across the whole subject.

Operational Case Study

The focus of Operational level is on the short term. In the Operational Case Study exam, your role will be that of a Finance Officer.

The Case Study exam is essentially a virtual business role play. Therefore, students need to understand their role within the case study exam in order to produce a good answer, demonstrating knowledge and applying skills from across the syllabus.

The table below provides an overview of the role students are expected to take on at Operational Study exam, who they will be seeking to influence and examples of the syllabus area they may be tested upon.

Who are you? At Operational level, your role will be that of a Finance Officer.

Equivalent job titles in a real organisation might be:- Junior/Trainee accountant

- Credit Controller

- Assistant accountant

- Cost accountant

What is the main focus of your role? Overall focus

Short termYou may be involved in

- Costing

- Preparing budgets

- Advising on product mix or performance

- Variance analysis

- Working capital or cash management

- Producing reports of performance against budget

- Risk assessment in short term decision making.

You will need to understand- The role of finance within the wider organisation

- Who the stakeholders are

- The regulatory environment

- How to communicate with non-financial staff.

Who is your audience/who are you seeking to influence? Your manager (Finance Manager/Finance Director), peers within the finance department and possibly in other departments; you may need to gather information from or present budget information to non-financial colleagues.

Examples of topic areas and tasks you may be asked to look at in the exam (based on Variant 1 of the Nov 2015 Management Case Study exam)Your role

You are a newly appointed Finance Officer in a family run horticulture company. Your predecessor has begun to set up some budgets and costings but the finance and administrative processes in the company are unsophisticated and there is little automation.

The emphasis in the Operational Case Study exam is the Performance pillar and Technical skills but all subjects will be tested. During the exam you will need to demonstrate:Technical skills

Planning and monitoring cash flows and the use of rolling budgets (F1 C3 and P1 B4)

Interpreting variances (P1 A1)

Treatment of R&D costs in financial statements (F1 B2)Business skills

Show understanding of how the finance function benefits the business (E1 B2)People skills

Explain why collaborative supply chains are useful to the business (E1 D1)Leadership skills

Leadership skills only account for 6% at this level and no one will fail due to a lack of leadership skills in the OCS. However they are tested eg in the variance analysis task above, discussing how planning and operational variances benefit the business would have attracted leadership marks.Competency weightings for your exam Competency Weighting is the basis of distribution of marks from various sections in the exam. You will have to obtain minimum threshold marks (approximately 1/3) for each competency (except for Leadership skills) along with a scaled score of 80 to pass the exam.

Technical skills – 64%

Business skills – 16%

People skills – 14%

Leadership skills – 6%Management Level

By passing the level, you will gain the CIMA Advanced Diploma in Management Accounting

Management level is the second level of the CIMA Professional Qualification and consists three subject areas.E2 Project and Relationship Management

P2 Advanced Management Accounting

F2 Advanced Financial Reporting

Management Case StudyE2 Project and Relationship Management

Management level

E2 emphasises a holistic, integrated approach to managing organisations, from external and internal perspectives. It builds on the understanding of organisational structuring gained from E1 and is centred on the concept of strategy and how organisational strategy can be implemented through people, projects, processes and relationships. It provides the basis for developing further insights into how to formulate and implement organisational strategy, which is covered in E3.

Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.Weight Syllabus topic 30% A. Introduction to strategic management and assessing the global environment 20% B. The human aspects of the organisation 20% C. Managing relationships 30% D. Managing change through projects P2 Advanced Management Accounting

Management level

Focusing primarily on the long term, P2 builds on the insights about costs and their drivers (from P1) to provide the competencies needed to analyse, plan and manage costs to support the implementation of the organisation’s strategy. It shows how to manage and control the performance of various units of the organisation in line with both short-term budgets and long-term strategy. Finally, P2 covers investment decision making and the risks associated with such decisions. It provides the basis for developing deeper understanding of various types of risk affecting the strategy and operations of organisations (covered in P3).

Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.Weight Syllabus topic 25% A. Cost planning and analysis for competitive advantage 30% B. Control and performance management of responsibility centres 30% C. Long-term decision making 15% D. Management control and risk F2 Advanced Financial Reporting

Management level

F2 builds on the competencies gained from F1. It covers how to effectively source the long-term finance required to fund the operations of organisations, particularly their capital investments. It also deepens the coverage of financial reporting to more complex aspects of group accounting and analyses the rules governing the recognition and measurement of various elements of the financial statements. Finally it shows how to analyse financial statements to provide insights about the financial performance and position of the organisation over time and in comparison with others.

Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.Weight Syllabus topic 15% A. Sources of long-term finance 60% B. Financial reporting 25% C. Analysis of financial performance and position Assessment

Format: computer based Objective Test

Availability: on demand at any of the 5000 Pearson VUE centres around the world

Length: 90 minutes

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. They test all component learning outcomes across the whole subject.

Management Case Study

The focus of Management level is on the medium term and monitoring and implementation of strategy. In the Management/Gateway Case Study exam, your role will be that of a Finance Manager.

The Case Study exam is essentially a virtual business role play. Therefore, students need to understand their role within the case study exam in order to produce a good answer, demonstrating knowledge and applying skills from across the syllabus.

The table below provides an overview of the role students are expected to take on at Management and Gateway Case Study exam, who they will be seeking to influence and examples of the syllabus area they may be tested upon.Who are you? At Management/Gateway level, your role will be that of a Finance Manager.

Equivalent job titles in a real organisation might be:- Management Accountant

- Financial Controller

- Financial Analyst

- Head of Finance

What is the main focus of your role? Overall focus

Medium term and monitoring and implementation of strategyYou may be involved in

- Analysing cost information and advising on product investment decisions

- Assessing/advising on risk

- Pricing decisions

- Performance measurement.

You will need to understand- The regulatory environment in depth

- The business environment

- Performance measures and improvement

- Change management

- Options for long term finance.

Who is your audience/who are you seeking to influence? Your manager (Senior Finance Manager), Financial Director, colleagues within the finance department plus other senior business managers – may be non-financial. Examples of topic areas and tasks you may be asked to look at in the exam (based on Variant 1 of the Nov 2015 Management Case Study exam) Your role

You are a Financial Manager in ABC Solutions; ABC is an IT service provider founded in 1996 by 3 friends. The company is in Kayland, an industrialised country in northern Europe with an advanced economy and a sophisticated infrastructure. During the exam you will need to demonstrate:Technical skills

Conduct value chain analysis (P2 A1)

Analyse the impact on Return on Capital Employed, including a discussion on how ROCE could be affected in different years by gains or losses on disposal F2 C1)Business skills

Identify the economic substance of a contract (F2 B1)People skills

Evaluate the performance of a departmental head (P2 B2)Leadership skills

Explain the challenges associated with managing business relationships (E2 C2)Competency weightings for your exam Competency Weighting is the basis of distribution of marks from various sections in the exam. You will have to obtain minimum threshold marks (approximately 1/3) for each competency along with a scaled score of 80 to pass the exam.

Technical skills – 39%

Business skills – 16%

People skills – 21%

Leadership skills – 24%Strategic Level

Strategic level

Strategic level is the third and final level of the CIMA Professional Qualification and consists of three subject areas.

The technical content at the Strategic level

The Strategic level concentrates on making strategic decisions and providing the context for which those decisions will be implemented. Its focus is the long-term.

E3 Strategic Management

P3 Risk Management

F3 Financial Strategy

Strategic Case StudyE3 Strategic Management

Strategic level

E3 builds on the insights gained from E1 and E2 about how organisations effectively implement their strategies by aligning their structures, people, process, projects and relationships. E3 aims to develop the skills and abilities of the strategic leaders of organisations, enabling them to create the vision and direction for the growth and long-term sustainable success of the organisation. This involves successfully managing and leading change within the process of strategy formulation and implementation.

Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.Weight Syllabus topic 20% A. Interacting with the organisation’s environment 30% B. Evaluating strategic position and strategic options 20% C. Leading change 15% D. Implementing strategy 15% E. The role of information systems in organisational strategy P3 Risk Management

Strategic level

P3 shows how to identify, evaluate and manage various risks that could adversely affect the implementation of the organisation’s strategy. It provides the competencies required to analyse, evaluate and apply the techniques, processes and internal control systems required to manage risk. This insight is then used to manage the risks associated with both cash flows and capital investment decisions – two important areas of organisational life for which the finance function is responsible.

Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.Weight Syllabus topic 20% A. Identification, classification and evaluation of risk 20% B. Responses to strategic risk 20% C. Internal controls to manage risk 20% D. Managing risks associated with cash flows 20% E. Managing risks associated with capital investment decisions F3 Financial Strategy

Strategic level

F3 focuses on the formulation and implementation of financial strategy to support the overall strategy of the organisation. Using insights gained from F1 and F2, it provides the competencies to evaluate the financing requirements of organisations and the relative merits of alternative sources of finance to meet these requirements. Finally, it develops the competencies required to value investment opportunities including the valuation of corporate entities for mergers, acquisitions and divestments.

Summary of syllabus

Each subject is divided into a number of broad syllabus topics.

A percentage weighting is shown against each syllabus topic and is intended as a guide to the proportion of study time each topic requires.

It is essential that all topics in the syllabus are studied, as all topics will be examined. The weightings do not specify the number of marks that will be allocated to topics in the examination.Weight Syllabus topic 25% A. Formulation of financial strategy 35% B. Financing and dividend decisions 40% C. Corporate finance Assessment

Format: computer based Objective Test

Availability: on demand at any of the 5000 Pearson VUE centres around the world

Length: 90 minutes

Marking: computer marked

Results: provisional result available immediately followed by confirmation no more than 48 hours laterFurther information

Objective Tests are comprised of a range of items including short multiple choice questions, number entry questions, drag and drop questions and other formats. They test all component learning outcomes across the whole subject.

Strategic Case Study

The focus of Strategic level is on the long term and setting the strategy for the business. In the Strategic Case Study exam, your role will be that of a Senior Finance Manager.

The Case Study exam is essentially a virtual business role play. Therefore, students need to understand their role within the case study exam in order to produce a good answer, demonstrating knowledge and applying skills from across the syllabus.

The table below provides an overview of the role students are expected to take on at Strategic Study exam, who they will be seeking to influence and examples of the syllabus area they may be tested upon.Who are you?

At Strategic level, your role will be that of a Senior Finance Manager.Equivalent job titles in a real organisation might be:

- Senior Management Accountant

- Group Accountant

- Financial Director

What is the main focus of your role?

Overall focus

Long term and setting the strategy for the business.You may be involved in

- Measuring, analysing and managing risk

- Advising on strategic decisions

- Investigating potential business developments and investments

- Advising on long term sources of finance and financial strategy.

You will need to understand

- Leadership and its role achieving change management

- The full context in which the business operates

- The importance of looking ahead and advanced planning.

Who is your audience/who are you seeking to influence?

Chief Financial Officer/Board, senior management team – other senior non-financial staff.

Examples of topic areas and tasks you may be asked to look at in the exam (based on Variant 1 of the Nov 2015 Management Case Study exam)

Your role

You are a Senior Finance Manager employed by Wodd, a forestry company which was founded in 1983 and has been a quoted company since 2001. Wodd is based in Marland, a European country, heavily industrialised in the South, but with large uninhabited areas in the North. Its climate is temperate and is well suited to growing timber.The emphasis in the Strategic Case Study exam is the Enterprise pillar and showing a balance of skills across all competency areas but all subjects will be tested. During the exam you will need to demonstrate:

Technical skills

Advise on the implications of diversification for shareholders and directors (P3 E1)Business skills

Advise on predicting the impact of a weakening USD (E3 A1)People skills

Advise on briefing analysts (F3 C2)Leadership skills

Advise on managing the share price (E3 B1)Competency weightings for your exam

Competency Weighting is the basis of distribution of marks from various sections in the SCS exam. You will have to obtain minimum threshold marks(approximately 1/3) for each competency along with score of 80 to pass the Strategic Case Study exam.

Technical skills – 25%

Business skills – 25%

People skills – 25%

Leadership skills – 25%

-

Syllabus Document

Find out more about the CIMA Professional Qualification (2015 Syllabus & Assessment)